Inside Hinge: The Dating App That Wants You Gone

A brand breakdown of how a heartbreak-fueled startup became the world's fastest growing dating app and I would do if I was Head of Growth

Written by Jade Conner

There have been two major transitions in mating in the last four million years.

The first was in the agricultural revolution, when we became less migratory and more settled, leading to the establishment of marriage.

The second was with the rise of the Internet.

Today, we’re diving into Hinge - the dating app that was “designed to be deleted”… and somehow ended up the #1 dating app in Australia, UK, Canada, and the Nordics.

Hinge is a rare consumer subscription business where users leaving is the goal. And somehow, that made it Match Group’s fastest-growing product with US$550m in revenue and users paying 79% more compared to Tinder.

In this article, we unpack the full arc:

How a founder’s breakup turned into a US$550m revenue generating business

Why Hinge blew up after being pulled from the App Store

What Match Group saw in Hinge (and how it fits their master plan)

How Hinge turns churn into growth

The revenue model

Misaligned incentives between shareholders and users

Non obvious insights

And: what I would do if I was Head of Growth

It’s a case study in timing, product intuition, and turning a counterintuitive promise into a competitive moat. Let’s get started.

Origins (2011-2015)

Hinge was born out of heartbreak. Founder Justin McLeod had just gone through a breakup with his college girlfriend, Kate, and the experience left him thinking about modern dating and how it could be better.

In 2011, while finishing his MBA at Harvard Business School, he started working on an app called Secret Agent Cupid - a prototype that connected users through mutual Facebook friends (inspired by how people naturally meet in real life).

The focus was on finding people who are already in your social network.

The “Designed to Be Deleted” Rebrand (2016)

Nancy Jo Sales’ 2015 Vanity Fair article, “Tinder and the Dawn of the Dating Apocalypse,” exposed how apps like Tinder and Hinge were fuelling a culture of casual hookups, gamified swiping, and emotional detachment - particularly among young men in urban settings.

“With these dating apps, you’re always sort of prowling. You could talk to two or three girls at a bar and pick the best one, or you can swipe a couple hundred people a day - the sample size is so much larger.”

The backlash was sharp enough to spark a reset: Hinge’s founder Justin McLeod cited the piece as a catalyst for taking Hinge off the app store entirely and rebuilding Hinge 2.0.

They distilled the problem with the current dating app landscape:

Users were swiping a lot - but only 15% of matches were turning into actual conversations.

Hinge was the best for relationships, but it wasn’t enough. On a 1–10 (hook-up to relationship) scale, Hinge was considered the most relationship-oriented app at a 7. When asked what they were looking for, 70% of users wanted something even more serious than Hinge.

Hinge relaunched with a clear promise: “the dating app designed to be deleted.”Instead of casual matches, Hinge rebuilt around meaningful conversations:

Limited daily likes: encouraging thoughtful engagement.

Profile prompts: making matches more personal.

The new app, crucially, required all users to pay US$7 per month on the logic that it would attract serious daters only. It also was their first attempt at making money.

This was shortly reversed after Hinge realised they rely on network effects to grow: the more users, the better the experience. Charging at the entry point shrank the user pool, hurting matches and growth.

Nevertheless, it was a radical positioning shift - one that bet the company’s future on a counterintuitive idea: that the best way to grow was to help people leave. And it worked.

Match Group Acquisition (2018-2019)

Match Group bought a 51% stake in Hinge in June 2018, gaining the right to acquire the rest within a year. The deal gave Hinge access to Match’s resources, marketing budgets and growth playbooks, helping it scale internationally.

Hinge’s downloads promptly exploded and Match quickly exercised its option, owning 100% of Hinge by Q1 2019. Under Match, Hinge finally began to make money.

Match Group, for context, has been publicly listed since 2015 (NASDAQ:MTCH) and is a holding company of many of the world’s largest dating platforms, including Tinder, OkCupid, Plenty of Fish, BLK, and The League. In 2024, Match generated US$3.5bn in revenue and is currently valued at ~US$8bn.

It was a smart portfolio play: Hinge could capture the “relationship-oriented” demographic, while Tinder dominated the casual dating scene. For investors worried about cannibalisation, the two apps serve different types of dating intent.

Dating is not one market, it’s a funnel of shifting intent. People move from curiousity → casual dating → committed relationships, constantly.

Tinder is the top of the funnel. It’s fast, gamified, and built for volume. Hinge is mid-to-bottom funnel; it’s more intentional and designed for people looking for relationships.

By owning both, Match maximises lifetime value across the funnel. If a user churns from Tinder to Hinge, Match doesn’t lose them - it upgrades them (especially given the Revenue Per Payer is higher for Hinge), meaning the switch is financially net-positive for Match.

Match doesn’t need each app to win individually. It needs the ecosystem to retain users longer than a single-product competitor could.

Hyper-Growth Under Match (2020-2025)

Match let Hinge keep its identity but poured resources into marketing.

Revenue leapt from US$8 million in 2018 to US$550 million in 2024

Hinge is the fastest growing segment at Match Group. In 2024, their revenue grew 39% vs Tinder, who grew just 1%

Paying users reached 1.53 million out of roughly 30 million total users by 2024 (5.1% conversion rate)

Importantly, paying users grew 23% in 2024 vs Tinder who declined 7% in paying users in 2024

Importantly, Revenue per Payer (RPP) for Hinge was US$29.94 vs Tinder’s RPP of US$16.68 (a 79% premium)

Revenue per payer is the average monthly revenue earned from a Payer

💡 People are willing to pay a lot more for love than hookupsHinge is emerging as Match Group’s growth engine, driven by a premium product strategy and positioning around meaningful relationships.

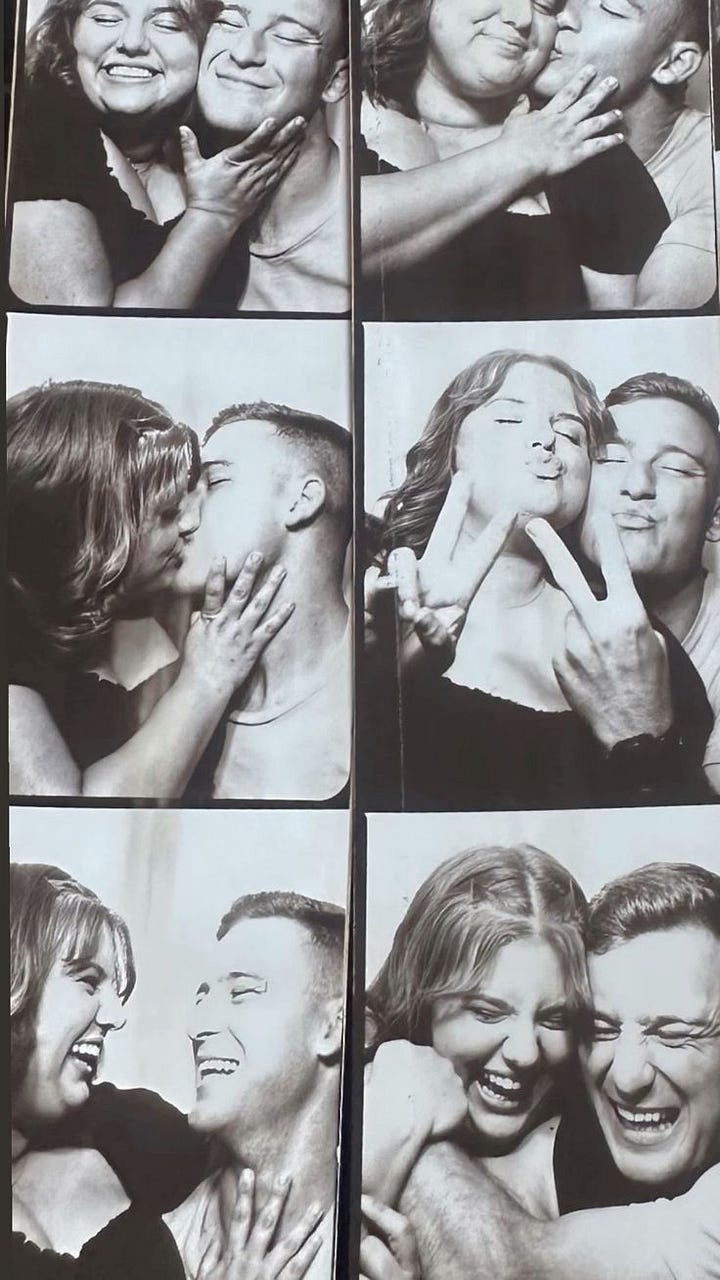

Wanna know something cute?

Eight years after Justin McLeod (Hinge founder) and his college girlfriend broke up, she was living abroad and engaged to a man she met on the trading floor of Goldman Sachs.

Justin sent Kate an email asking if they could meet. He showed up two days later at her doorstep. They sat down for coffee, and by the end of the weekend, Kate called off her wedding with just two months to go.

They have now been married for six years.

What’s Next (2026-2027)

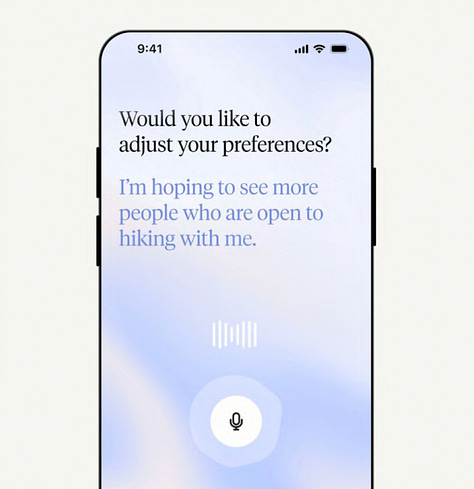

Justin McLeod believes the next frontier is AI-assisted date planning and profile coaching, cutting “choice overload”.

How AI is already helping:

Providing warm, personalised introductions

Understanding users on a deeper level

Helping users start conversations (i.e. relationship coaching)

There is a clear pathway to US$1 billion of revenue in 2027 for Hinge.

How does Hinge Make Money?

Hinge uses a freemium model.

This means users can swipe, like, and chat for free, but if you want more matches, better curation, and premium features, you better pay up.

Subscriptions:

Hinge+ (A$46.60/month) – unlocks unlimited likes, more filters

HingeX (A$66.30/month) – adds “most compatible” curation

Roses (A$4.99 each or in bundles) – sent to top-ranked profiles

Revenue = Paying Users × Revenue Per PayerPut simply, to grow revenue, you must convert more users to paying users and extract more value from each payer.

How do you increase the number of paying users?

increase the number of users by expanding to new geographies or targeting new demographics

make paying feel essential, not optional, by limiting likes and access to matches

How do you increase the revenue per paying user?

increase the price of your subscriptions and features (like Roses)

increase price discrimination via geography, gender, age or relationship intent. $15/month might be a splurge in Brazil, but a steal in NYC

Misaligned incentives between shareholders and users?

Critics question whether a product “designed to be deleted” can stay true to that promise under a public company structure incentivised to maximise shareholder returns.

Well, let’s look at it from first principles: what makes a good business?

Solves a real problem people care about ✅

Makes money consistently (strong margins, repeat customers) ✅

Builds an edge that keeps competitors out (brand, tech, network, etc.) ✅

So, let’s look at Hinge.

People love love. Dating apps solve for this.

Hinge makes money in an unusual way by turning churn into its competitive advantage.

This inversion - where success equals self-deletion - only works because:

Ever-renewing demand: roughly 1.5 billion singles globally are aging into, out of, and back into dating each year. Fresh cohorts offset departed lovebirds.

Upfront monetisation: Hinge is free to join, but its premium tiers capture value early when early enthusiasm meets friction (limited likes, blurred admirers, paywalled filters). That front-loaded cash flow means investors actually cheer churn, as long as acquisition costs stay low.

“Hinge users tend to engage deeply over shorter time periods… conversion tends to happen early in the experience.” - Match Group Q3 2022 Earnings Call

And here’s the kicker:

Success stories = free marketing: every deleted account becomes word-of-mouth advertising, lowering customer acquisition costs and lifting margins.

Wall Street - unclench yourself. The business model inherently works to maximise shareholder value.

By monetising users upfront, constantly replenishing the funnel with new singles, and turning every deleted-for-love account into free advertising, the model converts happy endings into higher margins and sustainable, shareholder-friendly growth.

Its business model flips the retention playbook: users leaving = brand building.

Non Obvious Insights

For Hinge, churn is how they grow. Success = deletion and deletion = free marketing. There are not many subscription business models where you are optimising for your customers to leave. Fertility trackers might be a rare example.

Match doesn’t just own dating apps, they own different stages of dating intent.

Hinge has more pricing power because it’s selling an outcome that people want (relationships) and place higher value on vs casual hookups.

If I was the Head of Growth for Hinge, here are the things I would be focusing on:

IRL / omni-channel presence

There’s a big opportunity to keep daters engaged online but also meet them halfway by giving them more reasons to show up offline.

If I was head of growth at Hinge, I would organise hyperlocal events in big cities - I’m thinking trendy venues hosting invite-only parties, book clubs at buzzy cafes, puppy yoga sessions in chic loft studios.

You make this cool (not cringe) by partnering with trendy local venues, creators, tastemakers to host the event.

just wrote an article for Vogue Business titled “From sauna socials to run clubs: Are community event leaders the new influencers?” - very fitting.Let them set the vibe and rebrand the intent. It’s not “a singles night.” It’s an invite-only social event with hot, fun, smart, funny people in your area.

If the goal is to convert more users to paying users, you make the events free to premium subscribers, paid for everyone else - monetising FOMO while translating digital matches into real-world chemistry. People are more willing to pay for a subscription if they can get real life value out of it.

If the goal is to get more users, entry to the event is simple: download Hinge and create a profile. It might be hard to find pockets of users who have not downloaded Hinge yet - but if you tried hard enough, you could do it.

You double down on untapped niches (e.g. newly single 30-somethings, international students, even oldies who want a new lease on life) and partner with local communities where Hinge hasn’t yet become the default. Think uni clubs, boutique gyms, coworking spaces, niche festivals.

Hinge Dinner Parties

Another idea would be an event where each person invites one Hinge match. Location would be a buzzy new restaurant, with big group dining tables. Hinge supplies food, playlist, conversation cards. I would add a photo booth because they are always very fun and flirty. Gives matches a fun bonding activity, but also, if your match sucks, you have plenty of other people at the table to chat to instead!

Again - I would offer this to paying users only. Free users can buy a ticket to come.

What this drives:

Shareable moments: These bring lapsed users back to the app but also brings new users who want to meet their person in person

Engagement: meeting face-to-face in a fun, low-pressure group setting sparks more in-app follow-ups and keeps users messaging and swiping longer

Speed Dating

Each table has a new prompt inspired from the Hinge profile building, something fun to start a conversation. At the end of the speed dating round, participants select their top 3 connections on the Hinge app - if there’s a match, they both get a “Date Credit” (e.g., $20 toward a restaurant or coffee). This gamifies the experience whilst also rewarding genuine sparks.

What this drives:

Engagement: the fun prompts break the ice immediately, so people are laughing and swapping stories from the start

Rewards connection: picking your top three forces a bit of thought (“Who really clicked?”) instead of mindless small talk. That means more genuine matches.

Keeps people coming back: the promise of a “Date Credit” makes you want to constantly check the app afterward (“Did my pick match me?”)

Double Dating

Gen Z daters are turning solo accounts into a team sport: two single friends run one Hinge account and look for other duos to go on double dates with (this is technically against the Hinge rules right now).

If I was at Hinge, I would lean into this idea and legitimise the trend into an official feature: two friends link their profiles to find other duos - or singles open to a double date.

From a business standpoint, it expands surface area: one subscription powers two users, two match funnels, and double the word-of-mouth. Friends who might not pay for Hinge solo are more likely to split the cost if it unlocks exclusive double-date access. The feature is social by design - more fun, more viral, and more culturally aligned with how Gen Z actually dates.

It also takes away the cringe. When you’re with a friend, nothing’s embarrassing. It’s like walking into a pole - mortifying alone, hilarious together. Double dating lowers the stakes, raises the vibe, and keeps people engaged longer.

Hinge built a business on the idea that less time on the app could be more valuable - for users and shareholders alike. The tension between finding love and maximising returns is what makes Hinge so fascinating as a case study.

If I were at Hinge, I wouldn’t chase mass downloads or pile on more premium features. I’d stay ruthlessly focused on helping people connect - faster, deeper, and ideally, offline.

Because if every deleted account is a growth engine, then the smartest thing Hinge can do is build a product worth leaving behind.

Real love stories make better marketing than any billboard ever could.

Got a brand you want decoded? Comment below.

Love how thorough this is. Also the growth section is very well thought out. Really like to see effort like this on here! Brava

This is great